Sneak Peek into our Industry Survey 2020: Focus on Impact Funds!

Build the community of funds that invest for impact

What is the EVPA Survey?

Now at its 7th edition, the EVPA Survey is tailored to the various types of capital providers active within the impact ecosystem, such as impact funds, foundations and engaged grant-makers, and financial institutions. Thanks to this new feature, we will be able to better capture and report the diversity of impact strategies implemented within the impact space.

In order to provide meaningful trends and analysis, we need all investors for impact to invest some time in the compilation of the questionnaire, and the time to do so is NOW!

How will data strengthen the community of impact funds?

We firmly believe this data analysis will help prove and claim the importance of impact funds that invest for impact with a broad range of stakeholders, such as policymakers, institutional investors and the general public; also exposing them to new fundraising and co-investment opportunities.

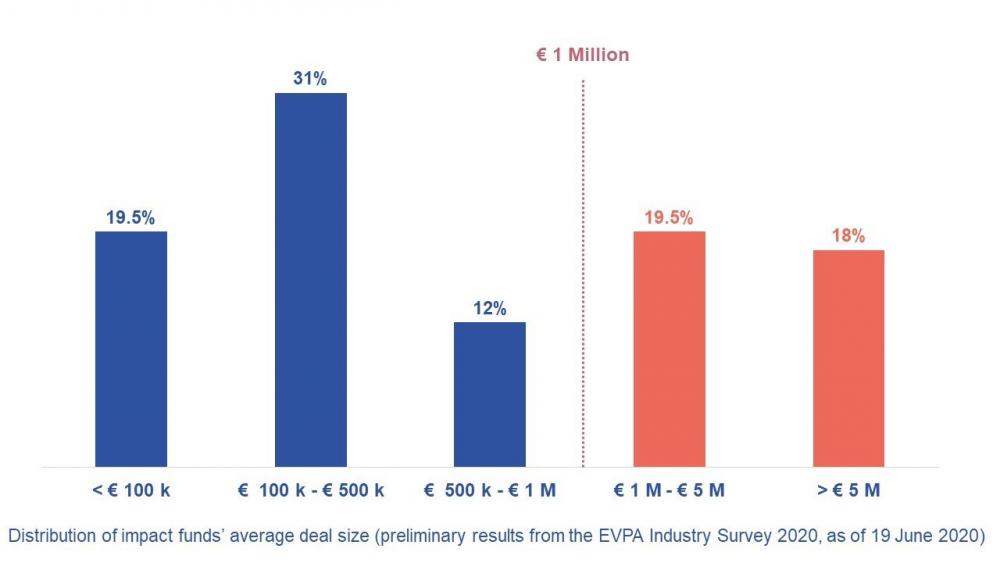

To give you a grasp of how this data could help impact funds position in the ecosystem, in the figure you can see the distribution of average deal sizes of the 51 impact funds managed by the 26 organisations that responded so far. Even though the analysis is preliminary, it already outlines smaller deal sizes compared to impact funds included in other market studies, such as the 2020 Global Impact Platform Fund Report published by Phenix Capital and the 2020 Annual Impact Investor Survey published by the GIIN. This result suggests that the funds investing for impact are extremely needed to help social enterprises get through the Valley of Death. Half of the responses so far report investments not exceeding 500k, which is promising since experts from the field identify a lack of funding for social purpose organisations needing tickets of this size range.

Furthermore, deal size is one of the key elements identified by our community of impact funds to be included in a collective database to help impact funds find new deals and co-investment opportunities. If you would like to take part in the working group that will co-create this shared database for impact funds in the coming month, please contact Christina Wu.

What will be the final outputs of the data collection?

Thanks to the new features of this edition of the Survey, we will produce an ad-hoc analysis and infographic/leaflet for impact funds, showing the diverse strategies and contribution to the sector of this specific category of investor! Among others, we will include statistics on total AUM, geographical focus, impact and financial return expectations.

Towards the end of 2020, we will also publish an online report that will cover a wide range of aggregated statistics, illustrating key aspects of the strategies and practices of investing for impact. In addition to updating the trends on elements already covered in the past, such as financial instruments used, types of non-financial services offered, social purpose organisations supported, and final beneficiaries targeted, we will enrich our analysis with new information on SDGs targeted, hybrid financial mechanisms, and impact measurement and management (IMM) tools/frameworks used.

Additionally, we will develop a dynamic tool that practitioners will have the chance to interact with, filtering for key characteristics, and customising their data visualisation to better benchmark against their peers.

What do my peers think about the survey?

Please find below the quotes of two experienced practitioners that responded to the survey dedicated to impact funds:

Is my Impact fund in scope of the study?

If your impact fund:

- provides direct financial support to social purpose organisations (e.g. NGOs, social enterprises, for profit businesses with intentional social impact), either in form of grants, debt, equity or other hybrid financial instruments;

- couples the funding with non-financial support;

- and focuses on impact measurement and management;

then you can contribute to this research and complete the EVPA investing for impact survey!

How can I take part in the study?

Please contact our Research Associate Gianluca Gaggiotti who will assist you.

Deadline to fill in the questionnaire: DEADLINE EXTENDED > until 17th of July

Will my data be safely stored?

All your data will be treated as confidential and will be password protected. We will only publish aggregate data and feature your organisation’s name in the final list of contributors, if you agree.

Thank you for your support!

The EVPA Knowledge Centre and the EVPA Impact Funds Initiative team