What is Investing for Impact

Definition of Venture Philanthropy

Venture Philanthropy (VP) is a high-engagement and long-term approach whereby an investor for impact supports a social purpose organisation (SPO) to help it maximise its social impact.

Who is involved and what are their role?

- Investors for impact can be highly-engaged grant-makers or social investors (e.g. foundations, social impact funds). They are willing to take risks that most other investors are not prepared to take in order to support SPOs’ innovative solutions. They adopt the Venture Philanthropy approach to support SPOs maximising their social impact.

- Social Purpose Organisations (SPOs) can be, for example, social enterprises, NGOs, or charities. They can be revenue generating or not. They have a solution to solve a pressing social or environmental issue, but often need resources (e.g. funding, human resources, capacity building).

- The “final beneficiaries” are those benefitting from the SPO’s services or products; e.g. minorities, people in poverty, people with disabilities, women, children, migrants, or the environment.

How does venture philanthropy work?

Investors for impact adopt the Venture Philanthropy approach by being highly-engaged and committed in the long term, applying the following three core practices to support the SPOs:

1) Tailored Financing: Choosing the most suitable financial instrument(s) to support an SPO. These instruments include grant, debt/loan, equity, and hybrid financial instruments. The choice of the financial instrument(s) depends on a number of factors, such as the investor for impact’s willingness to take risk, or the SPO’s business model and stage of development.

Click here for more information on tailored financing

2) Non-financial Support (NFS): Providing support services to a social purpose organisation in order to maximise its social impact, increase its financial sustainability or strengthen its organisational resilience.

For example: coaching the management team, giving advice on business planning, revenue strategy, theory of change, fundraising, etc.

Click here for more information on NFS

3) Impact Measurement & Management (IMM): Measuring and monitoring the change created by an organisation’s activities, and using this information/data to refine activities in order to increase positive outcomes and reduce potential negative ones.

Click here for more information on IMM

Investing for Impact

Who are investors for impact?

As defined in the EVPA Charter of Investors for Impact, Investors for impact…

- are problem-focused and solutions-oriented, innovating the way to tackle societal challenges

- put the final beneficiaries at the centre of the solutions

- are highly engaged for the long term, striving for lasting impact

- take risks that most others are not prepared to take

- measure and manage social impact

- provide extensive non-financial support

- tailor their financial support to the needs and characteristics of social purpose organisations

- proactively enhance collaboration with others

- work to foster the mobilisation of resources in the social impact ecosystem

- uphold high ethical standards

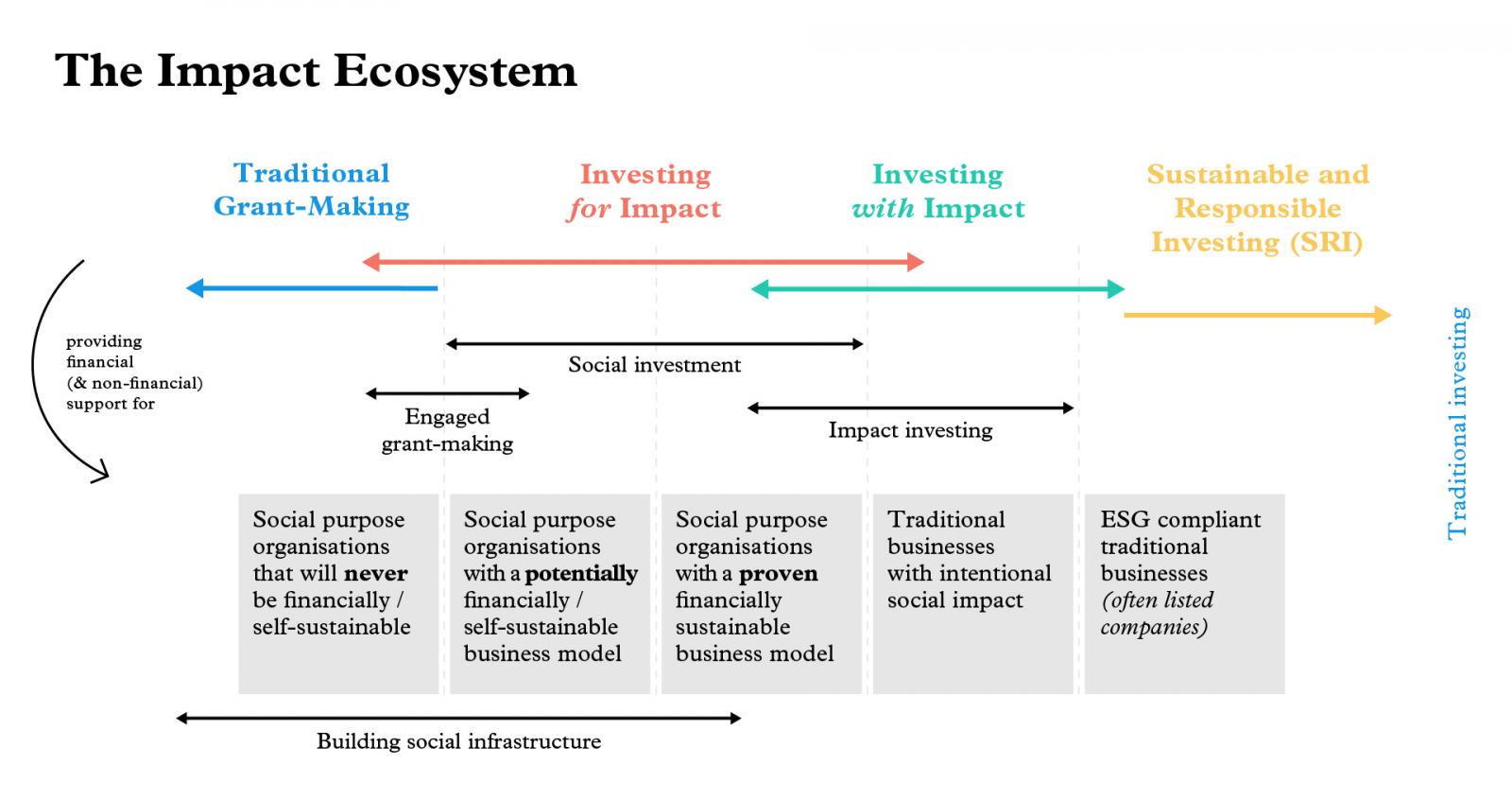

The impact ecosystem includes all types of capital and service providers supporting a wide range of social purpose organisations. It goes from traditional philanthropy (included) to sustainable and responsible investing (excluded), and in-between, EVPA has identified two main “impact strategies”: investing for impact and investing with impact. Within these two approaches, and depending on the business model of the investee, investors can do highly-engaged grant-making, social investment and/or impact investing.

The roles of investors for impact and investors with impact

|

Investors for impact |

Investors with impact |

|

|

|

Role in the ecosystem: |

|

|

scaling proven business models, making sure impact consideration is part of all investment decisions. |

|

|

|

For more information about these impact strategies, have a look at our resources on the topic here.

Real Life Example

Watch our documentary to discover how investing for impact can be applied with this success story of our member Ferd Social Entrepreneurs and their investee: Unicus.

Glossary

Still confused with the jargon of the impact sector? Consult our glossary of terms here