Drawing a Line

Spain makes the case for keeping some so-called impact vehicles out of bounds

Sustainable and impact investing are on the rise, yet the blurry distinction between them often leads to confusion and potential for “impact washing.” The SpainNAB Funds Task Force, with more than thirty entities representing the Spanish impact finance ecosystem, identified this issue as the main risk threatening capital mobilisation toward otherwise underserved social and environmental challenges. The task force underscored the need to draw a clear line to differentiate impact investing from other sustainable investment strategies and create a label to facilitate this distinction.

The difference between sustainable investing and impact investing

There is an urgent need to invest capital in ways that contribute specifically to underserved challenges and populations and lead to better outcomes than would otherwise have occurred— this is what impact investing entails. In the language of impact, it is not only about having the intention to generate a net positive impact (intentionality) and measuring that impact (measurability) but also about creating additional impact (additionality) for underserved groups and challenges.

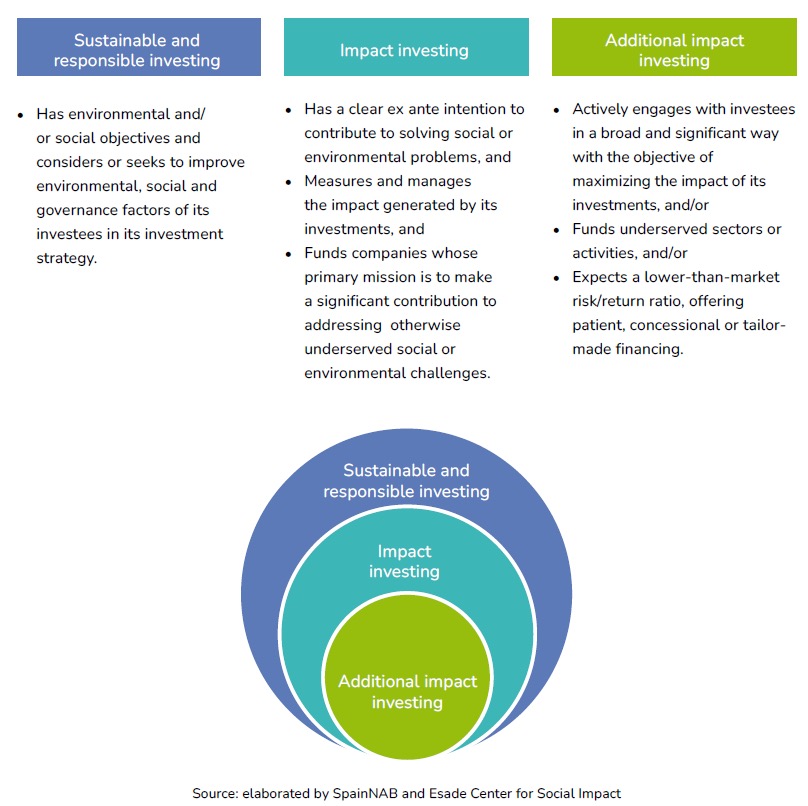

Additionality is complex and can have different sources. The task force articulated a framework to identify and segment impact investing depending on the source of this additionality (figure 1). It defines impact investing as a subset of sustainable investing, including all investments made into companies that create additional impact for underserved challenges (as well as demonstrating intentionality and measurability). A smaller subset in which the investor employs further strategies to create additional impact beyond what the company would otherwise have achieved is differentiated as “additional impact investing.”

Figure 1: Segmentation of the impact investing market proposed by the SpainNAB Funds Task Force

The Funds Task Force position paper, published by SpainNAB together with its academic partner Esade Center for Social Impact, summarises the details of the framework and the process through which it emerged. It builds explicitly on the impact classification system developed by the Impact Management Project (IMP), with the participation of more than 3,000 international experts, which is now available via Impact Frontiers.

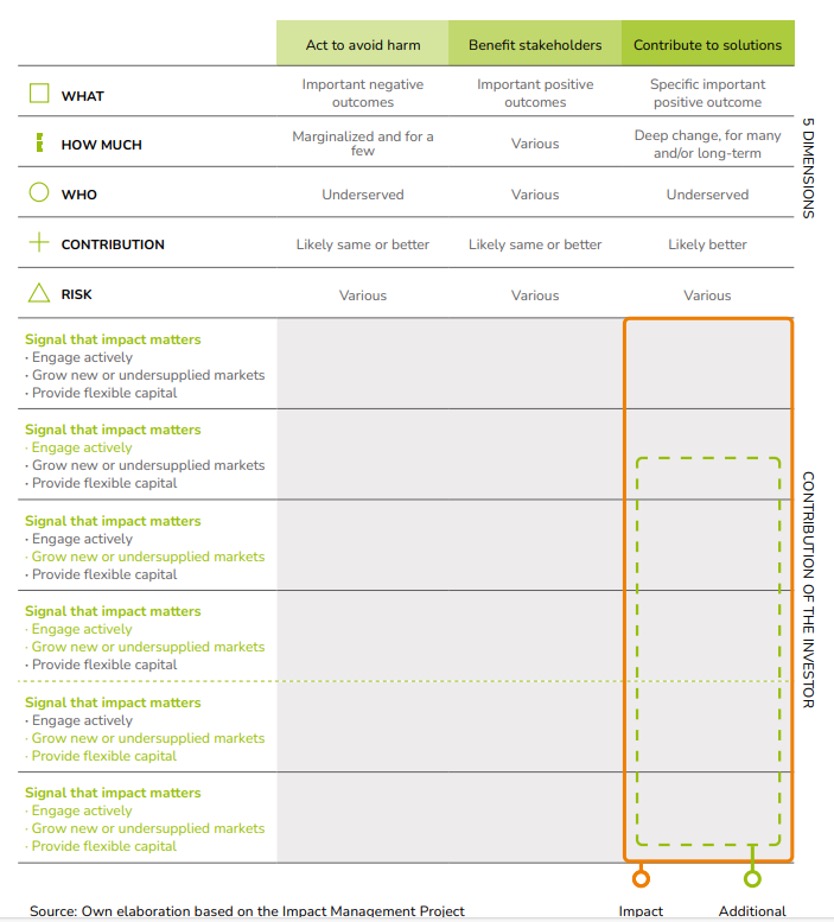

The IMP classifies an investment based on two dimensions: the impact generated by the invested company, and the contribution of the investor to that impact. Company impact is defined as class A (avoid harm), B (benefit stakeholders), or C (contribute to solutions) based on the analysis of five dimensions: what, how much, who, contribution and risk. In the task force’s framework, impact investing is synonymous with Class C investments (figure 2). This is a well-known and adopted distinction by many impact leaders, including other European NABs and Impact Europe (formerly EVPA) who have come together in the European Impact Investing Consortium to reach a common understanding.

Investor contribution can fall into six groups based on whether the investor employs strategies known as: signal that impact matters, engage actively, grow new or undersupplied capital markets and/or provide flexible capital. In the task force’s framework, classes C3-C6 are always considered additional impact investments, and C2 investments may be additional depending on the degree to which the engagement increases company impact.

Figure 2: Overlay of the SpainNAB Funds Task Force framework on the IMP classification matrix

Why draw a line: the case for capital mobilisation

The reason why these lines need to be clearly drawn is simple: only then can investors have the confidence and transparency they need to choose investment opportunities that match their impact and financial goals.

It will be possible to mobilise capital where it is most needed — that is, to the otherwise underserved challenges — when investment opportunities that address those challenges are clearly identifiable. Subsequently, appropriate incentives, regulations and support ecosystems can be created to funnel capital as intended. Until then, confusion and impact washing will dilute and divert the intended flows of capital.

In terms of portfolio construction, directing capital to underserved social or environmental challenges means investing in companies or projects providing solutions that address those challenges more effectively than available alternatives. Such solutions may be new and innovative or may simply be the only ones serving those challenges.

Data brings clarity!

Having rigorous, up-to-date data about these practices is essential to ensure the transparency and relevance of impact capital so that the sector can grow with integrity. For this purpose, the SpainNAB and the Esade Center for Social Impact publish an impact market sizing study annually. The most recent report, The Supply of Impact Capital in Spain in 2022, highlights key trends, progress and challenges, differentiating between impact investing and impact bank financing.

The report revealed that impact investing (including private impact funds, foundations and others) grew 58% to reach €1.2 billion in 2022, with the private impact funds segment doubling assets under management. This growth demonstrates the attractiveness of the sector in Spain, though challenges remain, considering that some segments of the demand still find it difficult to find financing. Impact bank financing (including ethical/social banking and impact finance cooperatives) reached €1.74 billion, showing a moderate but steady increase, and represents a fundamental part of impact capital in Spain in terms of volume, tradition and capillarity.

Furthermore, this year’s study also looked closely at the different types of investor contributions that define investor additionality: addressing undersupplied markets, providing flexible capital and offering broad and significant non-financial support focused on impact. In a first approximation, and recognising the difficulty of this measurement, we estimate that 67% of impact investment (and 55% of impact bank financing) can be considered additional impact investing, in which investor additionality is demonstrated through at least one of the forms of contribution.

Let’s unlock the potential for harmonised data

Having harmonised data about these impact practices at both national and European levels, in which all actors are assessed according to the same criteria, will help ensure a shared understanding of impact investing. Working toward this goal as part of the European Impact Investing Consortium, we have learned about the potential value this holds and about obstacles to overcome. At the top of the list, the current widespread lack of verified data about these impact practices means that producing reasonably reliable market data about them is very time- and resource-intensive. In Spain, we have been able to do so thanks in part to SpainNAB’s intensive efforts to educate investors, and the task force has recommended creating an impact investing label to standardise these practices.

The proposed framework to differentiate impact investing, together with initiatives that support harmonisation and verification of data about relevant impact practices, can help investors navigate the impact investing landscape and contribute to a more transparent and impactful ecosystem. Let’s strive for clarity and mobilise capital where it is most needed, so that impact investing can deliver on its promise to help solve society’s most pressing challenges.

Partners