From ESG to CSI: how do we spell IMPACT?

Are Corporate Social Investors the Key to Putting More ‘S’ in ESG Strategy?

What does ESG mean today?

In the rapidly evolving and expanding ESG space, confusion abounds and clarity is hard to come by.

It is no news that for the past few months ESG has been making headlines – and not in a good way! The lack of clarity and controversy surrounding ESG is causing significant backlash, and also hindering progress towards the Sustainable Development Goals (SDGs), a focus of many European impact players.

It’s a context that poses great challenges for impact actors generally, but especially corporate social investors (CSIs, i.e., corporate foundations, impact funds, accelerators or social businesses), whose work is sometimes linked to ESG programs. This report intends to investigate these challenges and the effectiveness of CSIs’ approaches today. Before we can launch this effort, however, let’s first define our terms.

Sharing language

Shared, precise language about ESG can help us cut through the clutter about what ESG activities can and cannot achieve for impact. In a concise but compelling article, Mark Horoszowski brings about much needed clarity regarding the different meanings and uses of ESG, and defined three denotations:

- ESG for Assurance: facilitating better financial decisions,

- ESG for Regulation: aiding the development of and monitoring of policies and compliance,

- ESG for Impact: making progress on the SDGs.

ESG for impact, which uses ESG data to make progress towards the SDGs, is the denotation most relevant for social impact professionals. ESG for Impact allows CSIs and related corporates to speak a common language, and set targets and KPIs. It is useful not only for risk management (valued by the business) but for fuelling innovation to build business models for the future as a purpose-driven company (valued by both the CSI and the business).

We take advantage of Horoszowski’s classification to frame our study(1); our insights are about ESG for Impact.

Why should CSIs care?

Beyond the current lack of clarity around ESG’s definition, there’s another key pressure for today’s CSIs (indeed it’s a pressure that inspired EVPA’s research team to launch the interviews we used for this report): new and tighter reporting requirements are coming soon.

The Corporate Sustainability Reporting Directive (CSDR) is potentially disruptive due the requirements’ focus on double materiality, the mandatory independent assurance of the reported information, but also due to the need to include forward-looking information about the company's long-term sustainability goals as well as their progress towards those goals. Accordingly, companies across Europe that fall under the regulation will seek to report more information necessary to understand the impact of the environment and society on the business, as well as the (positive and negative) impact that their operations have on people and planet.

In this context, some corporate social investors have voiced their concern regarding how this may affect them. They wondered whether, in order to boost their positive impact on people, some companies subject to the new regulation may turn to their related CSIs and seek to include, in their reports, the positive impact of these not-for profit vehicles on society (i.e., the contribution to the ‘S’ of the ESG). CSIs were also preoccupied with whether this may create pressure to contribute, with potential negative effects on their impact integrity.

Seeking to provide evidence-based guidance to CSIs, the EVPA Corporate Initiative research team set out to create a snapshot of the current status, looking to understand if and how CSIs contribute to the ‘S’ of their related business’s ESG or sustainability strategy. We also sought to understand the challenges they face in this process, what facilitates/hinders contribution and what contribution means for their impact integrity.

How corporate social investors contribute to the ‘S’ of ESG

We discovered that CSIs have different degrees of contribution to the ‘S’ of the ESG strategy of their related corporate. Their contributions can be classified as either ‘passive’ or ‘active’ depending on how they engage in the process. Furthermore, active contributors can be further subdivided into two categories – ‘limited’ or ‘engaged’ – based on the role that CSIs play in the development and implementation of the ESG strategy.

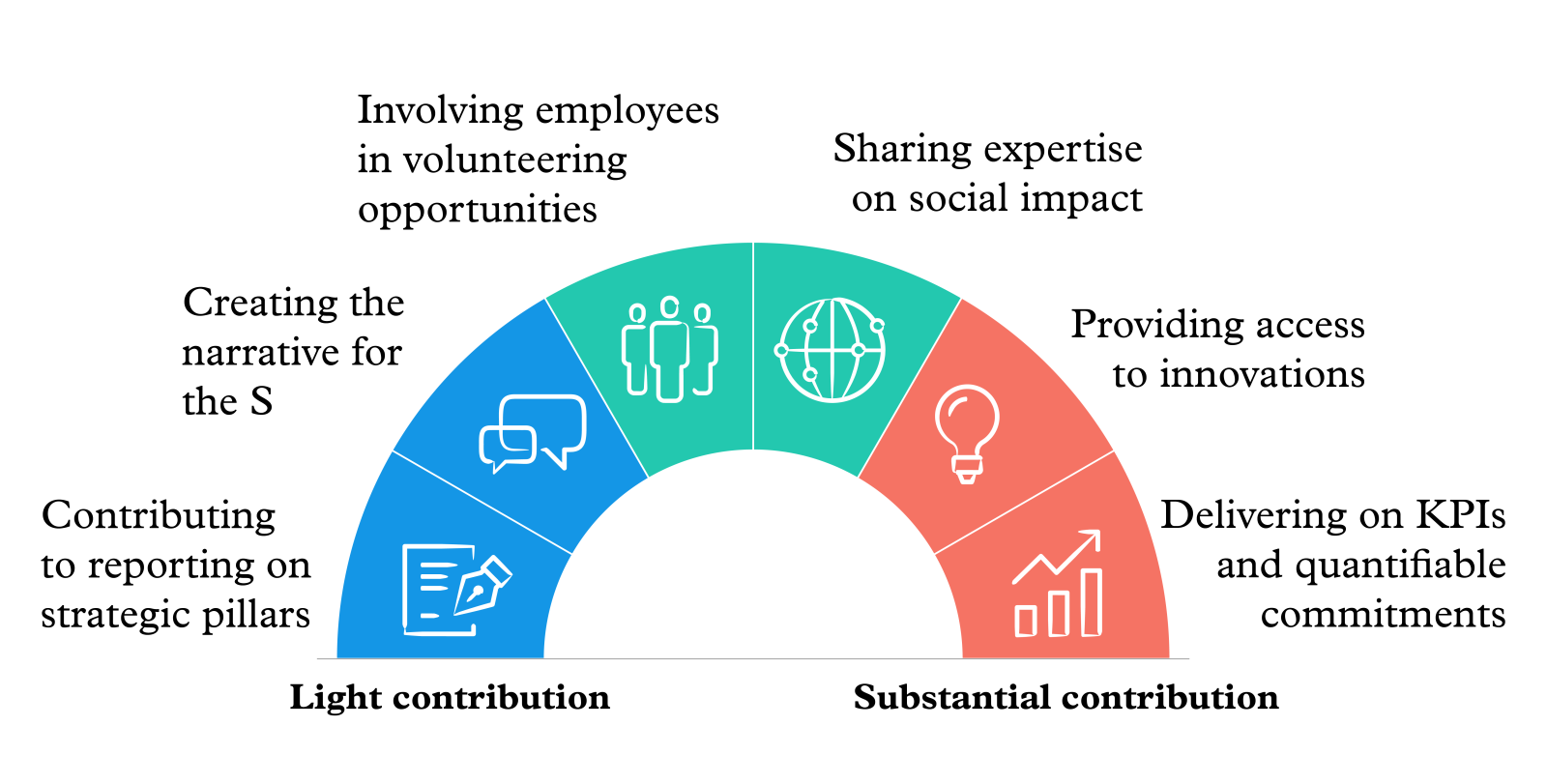

Contribution (whether passive or active) takes many forms in practice. Contributions (see Figure 1) can range from ‘light’ (e.g., providing information for non-financial reporting) to ‘substantial’ (e.g., defining social impact or setting KPIs). However, the lowest common denominator between passive and active contributors is contribution to nonfinancial reports(2), with 9 out of the 14 interviewed CSIs indicating that they provide information to the related business for this purpose.

Methodological note: Before setting out to interview a purposive sample of corporate social investors (n=14), developed based on our expert knowledge of the ecosystem and engage with relevant experts (such as rating agencies, international organizations etc.), we conducted and extensive literature review (academic and ‘gray’ literature, but also practitioner magazines). Following the semi-structured interviews, we used qualitative data analysis to distill key themes and insights that can enhance understanding and provide guidance for CSIs and corporates alike. Finally, we validated our results with an expert group.

Corporate readiness and senior management buy-in (they have to be the true believers described by Smith and Soonieus) are essential prerequisites for CSI contribution to be possible. Other key challenges include being heard and empowered by the senior management of the business, getting clarity over the roles that CSIs have in this context versus business functions that operate in the same areas (specifically in contributing to internal aspects of the ‘S’) and maintaining impact integrity in the process. CSIs will need to surmount these challenges to enable effective contribution.

Interestingly, while we expected closer strategic alignment with the business to be essential for contribution, the ability to contribute hinges on the aforementioned prerequisites. However, a closer alignment with the business allows for deeper levels of contribution across multiple business areas.

From intention to depth and breadth

Passive contributors have no intention of contributing to the ‘S’ of the ESG strategy of the business. They respond to requests for information on their activity, and are willing to be featured in non-financial reports, but do not actively seek to contribute to the ESG/Sustainability strategy of the company. However, by their very existence, CSIs contribute to the company’s narrative around the external component of ‘S’ (i.e., community) and their inclusion in the reports strengthens this narrative.

Active contributor CSIs are best positioned to have a deeper and more diverse contribution to the ESG strategy, but there are key differences between CSIs with limited contribution, and those that are engaged active contributors.

Active contributors with limited contribution (4 out of 14 interviewees) do not have an active role in shaping the ESG/Sustainability strategy of the company. Nevertheless, while the path is laid out by the company, CSIs, through their activities, bring contributions to the implementation of the ESG strategy. In addition, information on their impact is integrated in the company’s non-financial reports across different strategic pillars.

Conversely, engaged active contributors (7 out of 14 interviewees) play an active role in the ESG/Sustainability strategy development and implementation processes. As such, they are in a position to have input in and even shape the strategy, to contribute to strategic pillars and even co-develop/share KPIs with the related business.

Implications for CSIs

Despite ESG being around for almost two decades, CSI contribution to ESG strategy can still be considered pioneering, with a lot of space left for CSIs, companies and other key stakeholders to figure out the best way forward. This is both good and bad, leaving room for experimentation and learning, but also with little guidance available for both those looking to contribute as well as for those that – for one reason or another – would like to refrain.

CSIs looking to contribute can benefit from our work, which intends to foster understanding of the landscape and provides some orientation for those that are looking to contribute via concrete examples from the field.

Active contribution of the CSIs to the ‘S’ of the ESG strategy can be substantial and meaningful across different business areas, if prerequisites are met and certain enablers are present:

Prerequisites: corporate readiness and senior management buy-in.

Enablers:

- coherence with company purpose,

- having a favourable governance structure (i.e., having board members from the company),

- being part of the ESG strategy development process (in any capacity), and

- having common IMM frameworks and KPIs.

The way forward

The stakes of integrating these considerations into a CSI’s strategic decisions are high. While the effects of the CSRD have yet to trickle down to the level of CSIs, CSIs remain expectant that it will have an influence on their work. Therefore, CSIs should be ready to understand what contributing to the ‘S’ of the ESG means for them, the different ways in which they can contribute, what is required to be able to contribute (i.e., prerequisites and enablers), but also the implications of making a contribution, including aspects of impact integrity.

As more and more businesses are defining their purpose and are looking to have a positive contribution to society, active contribution to the ‘S’ of the ESG may represent an untapped opportunity for CSIs to influence the company’s impact journey.

As our interviewees indicated, there are good reasons to contribute but also good reasons not to contribute. However, it is important to note, refraining from an active contribution will not shield the CSI, as their activity may still be used by the company to boost the numbers on social impact of the business (via the narrative and the non-financial reporting).

CSIs can play in the world of ESG and still drive real impact; we’ve seen it first-hand. However, they have the best chance of success in this endeavour if the prerequisites/enablers discussed are firmly in place, and if they tread lightly, with their social mission and considerations of impact integrity as guides in this journey.

[1] Due to the pioneering nature of this topic, and the realities of the field (some CSI reported having both a sustainability and an ESG strategy, albeit for different purposes) we use the terms ESG strategy and Sustainability strategy interchangeably, but with the same meaning: a framework that makes social impact possible, measurable and comparable.

(2) Of course, contribution and integration of the CSIs impact in the nonfinancial reports varies, as passive contributors tend to be featured in separate/dedicated sections.