IMM Adapts

Phitrust’s impact thesis allowed LemonTri to implement social and environmental impact as their goals evolved.

The investor for impact

Olivier de Guerre and Denis Branche established the French management company Phitrust in 2003, with a strong belief that being a shareholder means having the power to act. They set up its first impact fund in 2006, dedicated to supporting the development of unlisted social impact companies, which was later complemented by a second and third fund in 2016 and 2023, drawing support from renowned institutional investors such as the European Investment Fund. These three funds currently fall under the investment company Phitrust Partenaires.

Phitrust's two-decade journey illustrates a commitment to impact investing that combines financial success with social well-being, prioritising two core activities. First, Phitrust aims at allowing everyone to find their place in society through economic integration, inclusion of people with disabilities, promotion of local professions, training and education. Second, Phitrust strives for making basic goods and services accessible to all through: financial inclusion; access to housing and counteracting energy poverty; sustainable and accessible food; and social and medical support. Up until today, the fund has supported over 45 socially and environmentally impactful companies.

Phitrust has also been an influential advocate for change in corporate behaviour through their shareholder activism, an effort that has been present since 2003. In 2011, they led the first environmental resolution in France on the multi-energy company Total Energies by collaborating with Greenpeace France and twenty other stakeholders to address environmental risks associated with intensive oil sands exploitation in Canada. This not only marked a significant milestone for environmental activism in France, but also reflected Phitrust's dedication to leveraging their shareholder influence for the greater good. Since then, Phitrust has submitted nearly 50 resolutions to hold listed companies accountable for their environmental, social, governance and ethical practices.

The three pillars of impact investing

Phitrust Partnenaires is a “for-impact” investment fund, where impact takes centre stage alongside economic sustainability. The fund aligns with the three pillars of impact investing: intentionality, measurability and additionality.

With the conviction that impact investing has the potential to guarantee positive long-term outcomes for the people and the planet, the fund's impact statement is focused on social inclusion and integration as well as to universal access to basic goods and services.

Phitrust has a long-term investment strategy to back up social enterprises in need of patient capital, simultaneously offering extensive assistance through specialised teams and a network of seasoned mentors — including former executives and experts in the field of inclusion.

Impact measurement and management is at the heart of Phitrust’s activities, serving as a guide for decision-making at every phase of the investment process, as displayed in the table below:

| Investment phases | How is impact embedded? |

| Multidimensional due diligence | Scrutinising the investee's theory of change (Theory of change), evaluating beneficiaries, conducting an assessment of the social mission using third-party research and academic papers, using the risk grid from Impact Management Platform, evaluating historical impact data, and formulating a detailed impact business plan. |

| Deal structuring | Impact-related clauses are included in legal documents which specify the corresponding key performance indicators (KPIs) and impact targets for 3 and 5 years ahead. The KPIs and impact targets are validated by Phitrust’s dedicated impact committee. |

| Investment follow-up | Collection of annual impact data and release of quarterly reporting. |

Three levels of impact

In tandem, Phitrust manages the three levels of impact: investee, investor and ecosystem.

The investee level refers to the impact that supported organisations have on people and the planet. Phitrust Partenaires directs all its funding towards small and medium-sized for-profit companies creating a positive social and environmental impact, particularly in the areas of social and financial inclusion.

The investor level refers to the impact that the investor has on the supported organisation. Phitrust plays an instrumental role in mobilising private sector investments for social inclusion and integration projects, which are often overlooked by traditional financing mechanisms. Phitrust’s financial support, which includes equity and quasi-equity investments, is complemented by extensive non-financial assistance, including technical support from the fund and experienced entrepreneurs with a track record on managing and growing businesses.

Additionally, Phitrust uses the CERISE-IDIA tool to measure their impact. The assessment evaluates the implementation of their impact thesis through an appraisal of social strategy, governance practices and products, business model and outcomes.

At the ecosystem level, Phitrust has taken an extra stride beyond their portfolio. Building on their role as impact investing pioneers in Europe, they have contributed towards building stronger French and European ecosystems by transparently sharing and promoting their best practices. This involves active participation in work groups and impact investment networks like Impact Europe, of which they have been members and board member since its inception.

Replication and adaptation have also been core activities for Phitrust. They identified successful projects in which they have invested, initially implemented in one country, and develop them in different locations with local partners. An example of this is the creation of MicroEurope, an impact fund that supports European microfinance institutions. The fund’s foundation is built upon the expertise of microfinance professionals across Europe, with Phitrust drawing on their investing experience in the Italian microfinance institution PerMicro in 2010. Launched in 2022 together with Seed Capital Bizkaia and Banca Etica, its goal is to, “finance and support the growth of microfinance institutions and social financial service providers in Europe.”

The entire Phitrust team is involved in the analysis and collection of impact data at the three levels. Additionally, Phitrust has one Impact Assessment Officer responsible for implementing and innovating the fund’s IMM practices.

From bin to blueprint

Nearly 300,000 tons of household packaging in France ended up discarded outside the home in 2021. Of this amount, only 55% of plastic bottles and a mere 1% of the 5 billion disposable cups used annually in the country are properly recycled.

Compared to the 89% of French citizens who properly sort their household packaging, these figures represent a discrepancy between behaviours in the home and those in public spaces. According to CITEO, this was attributed to a lack of public awareness of eco-friendly practices and ways to encourage their adoption. In various consumer areas, such as universities, malls, companies or train stations, waste collection and sorting systems are often less structured.

In response to statistics like these, the French start-up Lemon Tri set forth a mission to transform the recycling landscape in France and bridge the gap between intention and action. Taking inspiration from Germany, Nordic countries and Canada, the team launched an initiative to place intelligent sorting machines for plastic bottles in public areas and company offices.

This hands-on approach aimed to address the infrastructural inefficiencies in the current French system. It was also crafted to encourage individuals to actively participate in recycling efforts. In doing so, Lemon Tri envisioned improvement in recycling rates while shifting people’s habits.

Phitrust meets Lemon Tri

In 2011, Lemon Tri first approached Phitrust seeking support. Despite the project's significant potential environmental impact (boosting recycling rates and improving waste sorting), its early stage and lack of focus on addressing social issues posed a hurdle for the fund, who recommended reassessing its value proposition to incorporate a social dimension.

Following their advice, Lemon Tri obtained the ESUS label (Solidarity enterprise of social utility) in 2013, and integrated to their mission — innovate and contribute locally to the development of a circular economy that respects people and their environment. In effect, Lemon Tri made a social commitment to employ individuals facing barriers to the labour market.

The strategic change extended beyond a mere label and instilled a shift in mindset; they followed through with their actions by collaborating with similar organisations, such as insertion companies, who would help them collect and sort the plastic waste.

In 2015, Lemon Tri not only secured funding from Phitrust for their ongoing enterprise activities, they also received financial support to set up LemonAide, a new reintegration company. LemonAide was designed to address two challenges at once: the lack of recycling in the away-from-home market and the high unemployment rates in the country. As more empty bottles filled Lemon Tri's machines and more waste was collected, the need for an effective collection solution became apparent. LemonAide was created to train unemployed individuals in recycling skills, such as lifting and machine operation. They work in collaboration with Lemon Tri, collecting, cleaning, and maintaining the waste machines, and then delivering it to Lemon Tri for processing.

Phitrust went beyond their support setting up the subsidiary. They also collaborated with the Lemon Tri team to develop a set of impact indicators, divided between social and environmental categories.

"Challenging the founders on impact measurement encourages them to prioritise impact," said the Phitrust team.

Phitrust understood the need for a long-term patient capital, crucial during the initial stages of operations, which required time and resources. This understanding informed the non-financial support they provided, which included contributing to maintaining Lemon Tri's subsidiary, LemonAide.

Phitrust’s approach to the theory of change

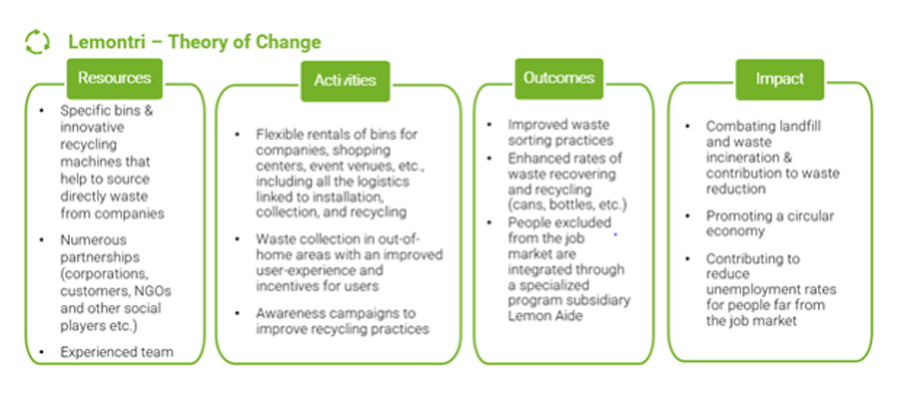

The theory of change is a tool for strategic decision-making for Phitrust. It is crucial in assessing whether a project's social intentions align with their overarching investment thesis.

Phitrust’s involvement with Lemon Tri clearly illustrates this idea. Initially, the enterprise concentrated on advancing a circular economy and providing flexible and practical recycling solutions for businesses and venues. Phitrust valued the founders’ motivation and intention to contribute to a more sustainable and less resource-intensive economy, yet they went beyond this acknowledgment and saw the potential this project could have in creating jobs for people excluded from the job market.

After Phitrust compared Lemon Tri’s theory of change with their own investment strategy, they initiated discussions with Lemon Tri about incorporating this social component into their business model. Lemon Tri’s founders appreciated the comprehensive approach it could bring to their initiative, and the discussions led to the creation of the subsidiary Lemon Aide.

This could only happen because both organisations clearly understood the overlap between their respective theories of change and associated expectations.

Selecting outcomes

Phitrust usually starts the due diligence analysis by examining the historical data and impact performance of potential investees, using them as a baseline to draw an impact business plan with the founders. Engaging in discussions with both the founders and key stakeholders, including employees and clients, provides insights for understanding the stakes of the activity and meeting the specific needs of all stakeholders.

Phitrust relies on an investment committee comprised of seasoned entrepreneurs with diverse backgrounds, who provide support in assessing the project feasibility and its management.

For this particular investment, Phitrust's prior investments in circular economy initiatives like Ecodair (which refurbishes IT equipment while creating jobs for individuals with mental disorders) and La Varappe (focused on waste management and job insertion) equipped them with expertise in measuring and managing impacts for the transition towards a circular economy.

The fund engaged with the eco-organisme CITEO, a non-profit entity established by consumer goods and distribution companies to minimise environmental impact, to gain insights into the sector and assess the environmental value of Lemon Tri's proposed solution.

Only after collecting and evaluating the compiled information did Phitrust and Lemon Tri collaborate on creating a mutually aligned list of outcomes and subsequent indicators. They based this list on a shared assumption: the more PET tonnes Lemon Tri recycled, the greater the reduction in CO2 emissions compared to those emitted during the production of new plastic bottles. Simultaneously, an increase in PET recycling by Lemon Tri would translate to greater employment opportunities for individuals otherwise excluded.

Risk mitigation

''We acknowledge that the perfect project doesn’t exist. As investors for impact, we believe that impact investors have the responsibility to invest in real impact solutions and not only opportunities, and we are prepared to place greater emphasis on impact achievements than on financial returns.''

-Phitrust team

As an early-stage impact investor, Phitrust bears the risk of financing relatively young projects that have a high propensity to fail. The fund mitigates such risk by putting in place good governance practices at investees’ boards and participating actively in board meetings.

Phitrust tackles risk in different ways depending on the stage of the investment process. During the due diligence phase, the fund uses the risk matrix from the Impact Management Project (IMP) to systematically chart potential impact risks. This tool is instrumental in identifying areas for improvement and implementing mitigation practices.

In addition to the IMP risk assessment, Phitrust has instituted a monitoring procedure for Environmental, Social and Governance (ESG) risks. The procedure was put in place in 2023 to complement the impact risk mitigation procedures: while impact risk assessment focuses on the company's core business and mission, ESG analysis ensures that business operations align with good social, environmental and governance practices.

Recognising the challenge of limited data disclosure on negative externalities by social enterprises, the fund actively raises awareness and provides training on reporting issues. Phitrust developed a comprehensive guide for entrepreneurs, equipping them with resources and tools to facilitate reporting. These initiatives are part of Phitrust's long-term strategic and operational support for its network.

Identifying indicators

Before establishing a set of impact metrics, Phitrust gave special attention to identifying and leveraging existing impact metrics previously adopted by Lemon Tri, ensuring a consistent and cohesive framework. As emphasised by the team, "impact indicators should serve as relevant KPIs that also aid managers in operational and strategic decision-making, and not a mere reporting tool for investors."

The table below outlines the established indicators and targets set in 2016, when the investment was launched. The selected indicators were linked to Lemon Tri’s operational performance; outcomes would be assessed after three-and five-years post-investment.

| KPI | 2019 target | 2021 target | 2024 target | 2026 target | |

| Social Impact | # jobs in integration and temporary work | ||||

| Positive exit ratio | 50% | 50% | 70% | 70% | |

| Environmental Impact | Tonnes of recycled PET | 2,000 | 5,000 | 1,000 | NA |

| Tonnes of collected waste | 3,000 | 7,000 | 15,000 | 25,000 | |

| Employees | Total # of FTE (Full-time Equivalent) | 40 | 53 | 200 | 300 |

As Lemon Tri continues to gather and recycle PET waste, its business expands with a rising clientele willing to pay for this service. Furthermore, increased recycling of plastic and general waste lead to a reduction in CO2 emissions, compared to those produced when manufacturing new plastic bottles. With business growth, more individuals facing labour market challenges are employed – bringing the organisation close to a lock-step model.

A purpose-driven deal, capable of pivoting

| Main characteristics of the investment | |

| Financial instrument(s) and amount invested | 2016: €500k in Equity 2019: €250k in Quasi-Equity (converted in 2021) 2021: €300k in Equity |

| Time horizon | 10 years |

| Non-financial support provided | Strategic support provided by experts in the field introduced by Phitrust, board activity, support on creating a strategic impact plan for the following years (social and environmental), monitoring of impact. Contribute to the creation of reintegration company LemonAide |

| Co-investors (if any) | 2016 & 2019: Business Angels, Aviva Impact Investing France, Inco 2021: Maif Impact, CDC, Aviva Impact Investing France, Inco |

In 2016, Phitrust committed to an initial equity investment of € 500K in Lemon Tri, with a 10-year time horizon and a set of impact indicators integral to the deal (see table above).

However, those indicators lasted only three years, as Lemon Tri pivoted from a singular focus on plastic bottles to a broader waste management approach.

Two primary factors influenced the decision to pivot. First, the initial business plan proved overly ambitious, and sales growth did not align with the initial projections. Second, the original model was narrowly focused, involving the installation of machines designed for collecting aluminium cans and plastic cups exclusively from the company's beverage dispenser rooms. Consequently, the market scope and revenue streams were limited.

In response to these challenges and in agreement with Phitrust, Lemon Tri shifted strategy. An overall company growth of 50% validated the decision. While this growth involved new contracts for the global collection of all the company’s waste, there has been a particular growth in waste collection. Surpassing plastic volumes, it implied a shift from the traditional sale of machines to a model focused on the sale or rental of bins.

Phitrust played an active role in this transition by understanding and adapting to Lemon Tri’s new strategy, while ensuring the adjusted KPIs and targets would be evaluated.

While social impact KPIs remained the same and were successfully met, 2019 targets for waste collection were redefined. As a result, while the recycled PET tonnage is lower than expected, the total amount and diversity of collected waste have increased.

A revision of the indicators can be found in the two following tables.

| Indicators overview - Social Impact | |||||

| Outcomes | Indicators | Baseline 2016 | Target 2019 | Result in 2019 | Growth |

| People excluded from the job market are integrated through a specialised program subsidiary Lemon Aide. | Employees in insertion | 6 | 40 | 22 | 260% |

| ‘’ | FTE in insertion | 6 | - | 18 | 200% |

| ‘’ | Successful exit rates | 50% | 68% | 68% | |

| Indicators overview - Environmental Impact | |||||

| Outcomes | Indicators | Baseline 2016 | Target 2019 | Result in 2019 | Growth |

| More waste collected in out-of-home areas | Tons of plastic recycled | 100 | 2,000 | 309 | 209% |

| Tons of carbon emissions avoided | 252 | 6,500 | 3,043 | 1,107% | |

| Enhanced rates of waste recovering and recycling (cans, bottles, etc.) | Tons of waste collected | 110 | 3,000 | 1,329 | 1,108% |

From pivoting to impact monitoring

Throughout these adjustments, Phitrust successfully maintained the integrity of the impact label by adhering to its impact monitoring procedures. As part of Phitrust’s internal protocols, they request quarterly updates from investees on the evolution of impact indicators. This information enables Phitrust to compile comprehensive trimestral reports for their investors.

The monitoring of impact indicators primarily occurs through active participation in board meetings. These meetings let the fund closely track the progress of social outcomes, offering a platform to propose changes and improvements when deemed necessary. Phitrust consistently encourages investees to allocate a dedicated impact section on the agenda of each board meeting.

Additionally, Phitrust implements a reporting framework for its investees, requesting a qualitative impact report on a quarterly basis and a minimum annual disclosure of impact metrics. This ensures ongoing assessment and transparency in tracking the investee's impact journey.

As part of their company portfolio, Lemon Tri also adheres to these reporting requirements by sharing the evolution of its indicators with all its shareholders. When Phitrust initially invested in Lemon Tri in 2016, both parties collaboratively defined impact metrics alongside other impact investors. This co-definition of metrics laid the foundation for robust impact measurement.

The investor landscape evolved during the second capital increase in 2021, with the inclusion of additional impact investors such as Banque des Territoires and Maif Impact. Phitrust facilitated alignment among new stakeholders to maintain the already established impact metrics; this showed a commitment to continuity and consistency in measuring impact.

Recognising Lemon Tri's strategic shift, stakeholders in the investment collaborated to add new metrics; they also refined and adjusted key performance indicators in line with the investee's evolving strategy.

This alignment among stakeholders not only helped mitigate the reporting burden for the investee, but also ensured a cohesive, standardised and transparent approach to impact management.

Phitrust aggregates and analyses investees’ impact data, in Lemon Tri’s case by consolidating KPIs at the portfolio level. Metrics include tons of collected waste and the number of inclusive jobs created (full-time equivalents).

Portfolio level impact performance

Phitrust goes a step further by calculating a weighted average of impact target achievement. This calculation takes into account the impact performance of all portfolio companies, providing a nuanced perspective on the collective impact generated across the investment portfolio. By synthesising these aggregated insights, the fund presents a holistic view of its impact performance to stakeholders, showcasing both the individual successes of portfolio companies and the overall effectiveness of its impact investment strategy.

As part of its commitment to transparency, Phitrust publishes an activity and impact report annually, dedicated to stakeholders, including investors, investees, potential prospects, managers and other investment funds of their network.

Phitrust's exit

''We can only say that we really played our role as an investor for impact when we ensured the continuity of the social mission after our exit.''

-Danaé Becht, Investment Manager at Phitrust

At Phitrust, impact is non-negotiable and cannot be seen as a check-box. For this reason, Phitrust strives for securing the investee's social mission long after their exit. Whether the fund entrusts shares back to the committed entrepreneur or finds resonance with a growing community of impact investors, every exit is a chance to secure impact in the right way.

Phitrust considers both social and financial returns equally important, and a successful exit is achieved when the investee has met its goals in terms of social impact, financial sustainability and organizational resilience. Phitrust provides non-financial support to ensure these three goals are met.

Phitrust works together with the rest of co-investors to manage the exit process and ensure alignment on the exit strategy. They are proactive in ensuring impact stays central to the investment strategy by looking for follow-on investors with similar values and advising ventures to prioritise those who offer non-financial support. This approach aims at sustaining continued growth while safeguarding the company's social activities from more commercially beneficial operations.

Partners: