Impact Institutions

Unleashing the full potential of National Promotional Banks and Institutions

National promotional banks and institutions (NPBIs) play a vital role in mobilising capital for sustainable growth and fostering the impact ecosystem. Typically established as public or publicly initiated entities, NPBIs are designed to provide essential financial support to national, regional or local policy objectives. Their unique status empowers them to strategically leverage public funds to stimulate both public and private long-term investments in sectors that are neglected by traditional financing, such as those addressing social and environmental challenges and promoting innovation.

Able to embrace risk categories the private market alone cannot, these institutions primarily concentrate on expanding investment volumes and engaging in high-risk investment strategies, like debt and mezzanine financing to start-ups and social ventures.

In contrast to other institutional investors, NPBIs employ a diverse array of risk-sharing financial instruments, grants and adaptable hybrid financial tools and long-term investments with flexible internal rates of return. In addition, many NPBIs offer tailored financing options that match the stage of development of the company or fund.

Three things investors for impact need to know about NPBIs

1. Public-private partnership enablers: . NPBIs act as financial intermediaries between public and private sectors; since they see both sides, they’re in a unique position to make these partnerships run more smoothly and cooperate more meaningfully.

2. Risk takers: . They take on risks that commercial banks and investment funds cannot or will not, while catalysing long-term investments from private capital providers.

3. InvestEU implementers: . Although InvestEU includes instruments under the Social Investments and Skills window, social investors can only access these financial instruments by engaging with its implementing partners, such as NPBIs.

Cassa Depositi e Prestiti (CDP) and Caisse des dépôts et consignations (CDC) are two NPBIs that have been instrumental in stimulating economic development, fostering partnerships and facilitating collaboration between the public and private sectors, acting as reliable intermediaries between the two. Through their successful facilitation of public-private partnerships, they have created a space where public and private sectors can build mutual understanding and confidence, and engage in meaningful cooperation.

Meaningful cooperation means funds are able to make direct investments and co-investments with a strategic, long-term outlook. One example, the Fondo Italiano D 'investimento, owned by CDP and a public-private network of eight other organisations, not only supports SMEs within crucial supply chains, it can also be credited with furthering the development of Italy’s impact finance market. To achieve these bilevel effects with such a diverse range of partners is a noteworthy achievement; it requires trust and collaborative practices at the vanguard of Europe’s impact finance space.

These practices are inspiring for any impact actor seeking to close Europe’s significant impact financing gap: approximately 1 billion euros, as identified in the EU Social Economy Action Plan.

This case study aims to explore the specific roles CDP and CDC play in diminishing the gap and successfully mobilising capital to bolster social impact initiatives. Like other NPBIs, CDP and CDC have proven to be essential allies for social economy actors. NPBIs more generally can be the key to enabling public-private partnerships, taking unique risks and accessing important financial instruments available through InvestEU.

Who's Who?

Let’s disambiguate the two NBPIs and their subsidiaries mentioned in this study:

Cassa Depositi e Prestiti (CDP) - Italy

- CDP Equity, one of CDC’s subsidiaries, is a patient long-term investor and acts according to market logic. It intervenes in strategic sectors, with adequate market returns are inherent to its mission: to support Italy’s development

- CDP Immobiliare Srl, another subsidiary, is a real estate agency offering asset management, project management and marketing of real estate projects, aiming to improve the real estate property assets owned by the Italian state, promoting both development plans and urban renovation.

Caisse des dépôts et consignations (CDC) - France

- Bpifrance S.A. is a subsidiary of CDC. A public bank at the service of business financing and investment.

- Banque des Territoires is a department of CDC. Provider of banking and financial services intended for local authorities, businesses, social housing organizations and legal professionals. It serves as entry point to the offers of Caisse des dépôts and its subsidiaries (Central Company for Territorial Equipment, CDC Habitat, Bpifrance, etc.)

How Cassa Depositi e Prestiti catalyses impact

Cassa Depositi e Prestiti was founded in 1850 and has supported the Italian economy to meet long-term challenges of development ever since. CDP converted from a public entity to a joint-stock company in 2003, a shift which allowed them to operate as a market participant and private investor, distinguishing it from many other national promotional banks that remain fully or largely owned by the state.

Notably, CDP's ownership structure includes banking foundations, which hold almost 16% of shares. These foundations, such as Compagnia San Paolo and Fondazione CRT, are deeply committed to addressing social and environmental challenges, and have played a pivotal role in influencing CDP's focus on impact-driven initiatives and topics. As project stakeholders, they contribute to shaping CDP's investment scope, exemplified in endeavours like social housing.

On this point, the Head of European Affairs at CDP, Martina Colombo, said, “CDP developed the current social and affordable housing concept alongside foundations. They are not only valuable partners but most importantly they co-invest on the fund level (ref. to FIA), allowing us to strike the right balance in the financial set-up of each project.”

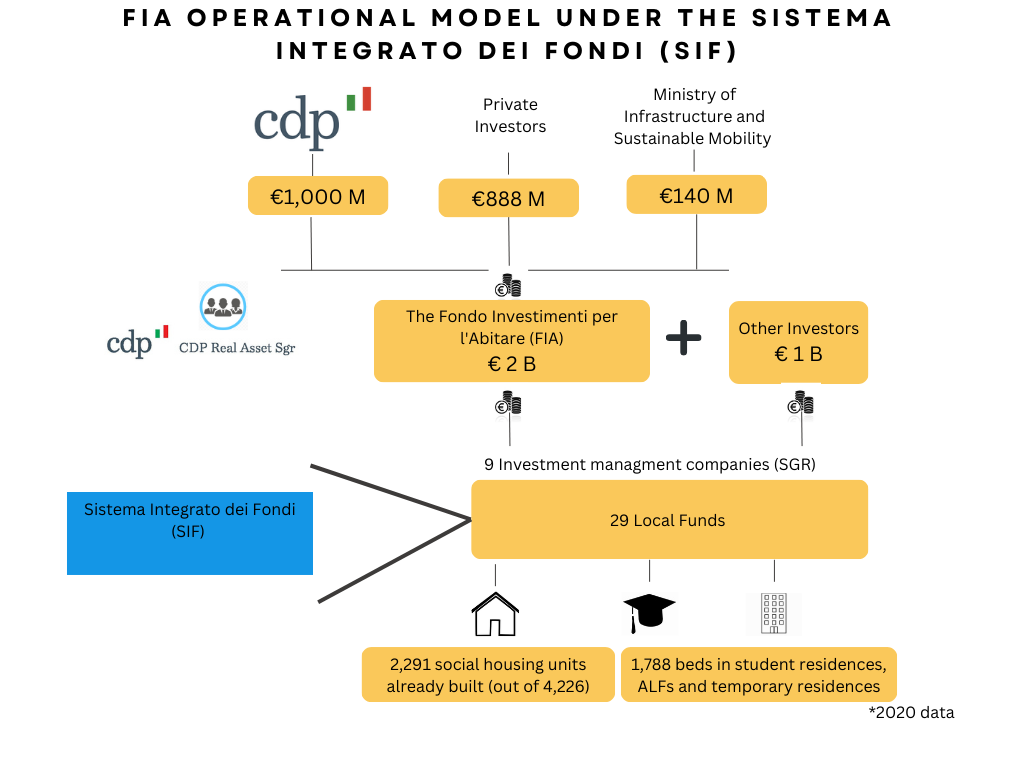

CDP has shown a longstanding commitment to social housing. A decade ago, the institution launched a substantial social housing program with support from the Ministry of Infrastructure and Sustainable Mobility, as well as banking and insurance groups and private pension funds. The Investment Fund for Housing (FIA), structured as a fund of funds, has already mobilised over €3 billion in financial resources, generating an impact of approximately €10 billion.

The FIA operates through an integrated funds system comprising 29 local real estate funds. The FIA serves as the reference investor, while stakeholders from across Italy act as co-investors; these include local banking foundations like Cariplo Foundation and Fondazione di Sardegna, regions, provinces, municipalities, housing cooperatives and private developers.

In the social housing sphere, CDP’s achievements have been reflected in the yearly studies of the Scenari Immobiliari, an independent institute for research on the real estate markets and local economies in Italy and Europe. The report ranks funds based on their assets and contribution to the local economy, and the CDP, due to its unique structure and the substantial resources it mobilised, secured first place in the “Value Added” funds category and fourth place in the general category1.

Another success story for CDP, especially in terms of euros mobilised, has been the Sistema Integrato dei Fondi (SIF). Born in 2006 with a budget of €3 billion raised from private and public investors, the SIF is promoted by Cassa Depositi e Prestiti and Fondazione Housing Sociale; it is considered one of the largest impact investing interventions globally.

One notable project within this system is Cenni di Cambiamento, completed in 2013. Located in the Quarto Cagnino neighbourhood, west of Milan's city centre, it represents the first undertaking realised within the SIF and has gained recognition as a pioneering effort in social and affordable housing in Italy. The development comprises four buildings and provides 122 social and affordable homes for individuals with varying incomes. The space offers not only residential services, but also common areas, public spaces, services and shops open to the neighbourhood. Cenni di Cambiamento serves as an exemplary model of inclusive and community-oriented housing; it differs from traditional housing models by actively involving and empowering tenants and the wider community throughout the design and management process. Additionally, Cenni provides opportunities for neighbourhood business activities, supporting small entrepreneurs and artisans to develop their businesses within an affordable and collaborative living environment.

Recognised with the prestigious European Collaborative Housing Award in 2017, Cenni drives transformative impact through their innovative funding structure, architectural design and inclusive approach. Through its transformation, innovative approaches and impactful projects like social housing, CDP has demonstrated its commitment to sustainable development and making a positive difference in Italy's social landscape.

The Caisse des Dépôts Group unlocks the power of partnerships

Caisse des Dépôts (CDC) plays a crucial role as one of the key institutions within the French state system. With a rich history spanning over 200 years, CDC has earned a reputation as a public long-term investor, trusted guardian and manager of public mandates. It has become an implementing partner of the European Commission when it comes to EU financial instruments, such as the InvestEU program, as is the case for its subsidiary Bpifrance, which is dedicated to the financing of enterprises.

CDC focuses its actions on three priorities: energy and ecological transformation; industrial, digital and financial sovereignty; and territorial and social cohesion. Thanks to its strong ties with local initiatives, combined with a European outlook, Caisse des Dépôts is a pivotal actor between ground-level solutions and EU institutions.

In recent years, CDC has taken significant strides in developing various funds to finance public interest projects and drive France's economic development. These funds have allowed CDC to deploy impact capital through a range of financial instruments, including traditional and blended finance options, as well as medium- to long-term bond issuance programs focused on green, social and sustainable initiatives.

One particularly impactful initiative led by CDC is the management of the national plan called Action cœur de ville. In collaboration with the French National Agency for the Cohesion of Territories and the National Housing Agency, this plan aims to facilitate and support the efforts of local authorities, encourage reinvestment in cities by housing and urban planning actors and promote the maintenance or establishment of activities in city centres. With a focus on improving living conditions in medium-sized towns, the project currently engages 234 French cities and involves a diverse range of public and private organisations and agencies. Beyond financial support, CDC also promotes innovative approaches and provides non-financial assistance to local authorities, real estate companies and social housing organisations, lending targeted expertise for comprehensive urban revitalisation efforts.

Other CDC initiatives depend on strong local partners. CDC, through its division Banque des Territoires, offers not only financial solutions but also non-financial assistance, such as advice on risk assessment, financial structuring of projects and legal service, to development players, including local authorities, social housing organisations and local public companies. For instance, the Atout Cœur project in Annecy, launched in 2019, is a local initiative that provides training and employment opportunities for young adults with mental health challenges. Despite legal requirements for employers to employ disabled workers, the unemployment rate for disabled individuals remains high at 14%, compared to 8% for the general population; Atout Cœur aims to rectify this negative trend. Banque des Territoires supports this project by providing a subordinated loan of €200,000, filling a gap that other financial actors typically do not address.

Through their diverse range of initiatives and financial solutions, CDC demonstrates a commitment to social impact and sustainable development. By leveraging their financial resources, expertise and non-financial assistance, they contribute significantly to addressing social challenges and promoting inclusive growth in France.

There is an organic relationship between CDC and private investors, as described by Nicolas Pinton, Europe Advisor at CDC department for EU relations: “The private investors know that when we invest, the business case and all the due diligences have been made. We usually invest under the market conformity principle and we crowd in private investors, in accordance with an internal requirement in our policies to have private investors along with us to make sure that we are not alone in investing and that we are at market conform.”

New roles, new potential

In 2010, the significance of National Promotional Banks and Institutions in the European economy came to the fore with the establishment of the Marguerite fund for sustainable infrastructure. The fund included four NPBIs (BGK in Poland, Cassa Depositi e Prestiti in Italy, Instituto de Crédito Oficial in Spain, Kreditanstalt für Wiederaufbau in Germany), the European Investment Bank and the European Commission. This marked a pivotal moment for NPBIs' involvement in fostering sustainable development in the EU.

In 2014, the Investment Plan for Europe and its European Fund for Strategic Investment (EFSI) became the primary tools for boosting economic recovery after the sovereign debt crisis in Europe. NPBIs proved their added value; they played a significant role in deploying the EFSI (also known as the Juncker Plan) managed by the European Investment Bank (EIB).

NPBIs played a crucial role in mobilising private sector investments by facilitating the support of strategic projects across Europe, increasing these projects’ potential for economic growth, innovation and job creation. Acting as financial intermediaries, NPBIs leveraged their expertise, local knowledge and financial capabilities to identify and structure projects. They also became co-investors: by committing their own resources alongside the EIB, NPBIs amplified the impact of the EFSI, ensuring that viable projects received the necessary funding, under flexible financing conditions and with lower interest rates/ cost.

Since EFSI finished in 2021, NPBIs have taken on a new role implementing InvestEU, the EU's investment program for the period of 2021 until 2027. InvestEU provides the EU with crucial long-term funding by leveraging both private and public funds, aiming to mobilise more than €372 billion in support of sustainable infrastructure, research, innovation and social investment.

NPBIs were a natural fit for implementing InvestEU, and not just because of their track record with EFSI. They are professional investors with in-depth knowledge of national and local investment ecosystems and needs; they leverage this knowledge to foster sustained and inclusive growth.

InvestEU represents a landmark: for the first time NPBIs are eligible to become direct implementing partners of the European Commission. Although private actors are ineligible to become direct implementation partners, they can partner with NPBIs and maximise their interest and involvement in mobilising capital towards impact – a means to make more actors impact actors.

The stakes for proper implementation of InvestEU are high – and so is the level of support. Under the InvestEU program, the EIB Group – EIB and the European Investment Fund (EIF) – supports investments that will benefit from a 75% guarantee of the European budget. The remaining 25% will cover investments supported by NPBIs and other international financial institutions, such as European Bank for Reconstruction and Development (EBRD) and the Council of Europe Development Bank (CEB).

InvestEU guarantees enable more impact

In 2023, CDP secured an InvestEU guarantee of up to €355 million, unlocking an additional €750 million of CDP financing for vital investments throughout Italy. These investments will bolster business research and development, facilitate ecological transition, enhance social and sustainable infrastructures and, notably, support the development of affordable social housing projects, with a substantial portion allocated to public-private partnerships.

Similarly, in November and December 2022, CDC signed two agreements with the European Commission to implement InvestEU. The latter is an InvestEU guarantee agreement for an amount of €350 million. This agreement will unlock at least €700 million of CDC finance for strategic investments across France. Commenting on the value of this development, Eric Lombard, Caisse des Dépôts General Director, said: “By being an implementing partner of the Commission under InvestEU, Caisse des Dépôts reinforces its capacity to invest for the benefit of the local development, the green transition and the social cohesion.”

The impact doesn’t stop there. The EU guarantee will cover CDC equity investments, which in turn will mobilise private investments for the rehabilitation and restoration of industrial wastelands, the development of data centres and investment in industrial infrastructure.

The other part of the guarantee will cover loans supporting the poorest urban areas in France and recovery from the COVID-19 crisis. But most importantly, €140 million of the EU guarantee is expected to contribute to climate and environmental objectives, making CDC an important contributor to the EU's sustainability goals.

The second signed agreement, titled "PVD +," serves as a complement to Banque des Territoires' involvement in the nationwide "Petites Villes de Demain" program. This additional agreement extends technical advisory support to project developers, aiming to advance ecological transition initiatives within these regions.

Bpifrance, as mentioned a subsidiary of CDC, signed a significant agreement with the European Commission for the implementation of InvestEU, securing €15 million in funding. This funding aims to bolster Bpifrance's support for French industry and business recovery amidst the challenges posed by the pandemic and Russia’s invasion of Ukraine. Bpifrance has already successfully completed 150 projects under this agreement. The funding offer will continue to be available until the end of 2027, ensuring sustained support for enterprises. Furthermore, this agreement encompasses an advisory component and a dedicated support group in collaboration with the EIF, focusing on fostering innovation, sustainability and competitiveness among enterprises.

More opportunities

There is a pressing need to scale up impact investments to support the global transition towards a future both fair and green. As public financial resources cannot finance this transition alone, unlocking private capital is essential.

As shown in the two cases discussed, NPBIs have the potential to take on risks that commercial banks and investment funds cannot or will not, while catalysing long-term investments from private capital providers.

Investors for impact are well advised to make note of NPBIs’ importance for this reason alone, but there’s also a more practical angle. Although InvestEU includes instruments under the Social Investments and Skills window, social investors can only access these financial instruments by engaging with its implementing partners, such as NPBIs.

The European Commission plays a crucial role in fostering partnerships between NPBIs and the private sector, thereby stimulating economic growth and innovation across Europe. Through its policy frameworks and initiatives, the Commission can create an environment that encourages collaboration and enhances the attractiveness of public-private partnerships.

The cases of CDP and CDC are what it looks like when this works. But there’s an opportunity to further amplify successes like these. The Commission has the potential to take on a greater role in facilitating knowledge sharing among NPBIs and supporting NPBIs in building local capacity to access funding and building the social economy ecosystem. Only then can these institutions truly learn from successes and failures and become full implementing partners in the implementation of the Social Economy Action Plan.

Additionally, there’s room for more of a concerted effort between the European Commission and NPBIs to attract more private capital. The Commission has the power to promote financial instruments and mechanisms that incentivise private sector participation in NPBIs’ projects. Incentives could include offering guarantees, co-investment opportunities and de-risking measures, all of which are attractive to private capital providers.

The achievements of CDP and CDC underscore the immense potential of NPBIs in shaping prosperous economies through strategic investments and collaborative partnerships. By following their blueprint, other NPBIs worldwide can unlock new opportunities, attract more private capital and effectively address pressing social and environmental challenges. Capital providers, in turn, can look to NPBIs for co-investment opportunities – especially if the Commission chooses to step in and promote more of them.

What's next?

As a part of EVPA’s Impact Week, taking place in Torino from 22 to 24 November 2023, we will discuss the catalysing role of NPBIs in the impact space and how they can team up with impact investors to bring more capital for impact. Join us!

With the support of: