Policy by the Numbers

How data and policy interact to finance the social economy — the example of French 90/10 funds

90/10 funds have unlocked a lot of social finance in France; as of 31 December 2022, €330 million flew towards socially responsible companies based on an investment stock of Finansol-labelled solidarity funds worth €1.2 billion.1 The funds themselves are enabled by pioneers, policies and ongoing data management which work together to address persistent failures in financing social enterprises.

FAIR represents the French ecosystem of social finance and catalyses data and insights. An important part of the organisation is the observatory for social finance and the policy department, which collect data on the social finance community in France and generates solutions to existing policy issues respectively. How the data managed by the observatory fuels action and sets impulses for policy is the focus of this article.

Before we come back to uncover the internal mechanisms, let’s look at the nature and history of 90/10 funds.

90/10 funds definition and purpose

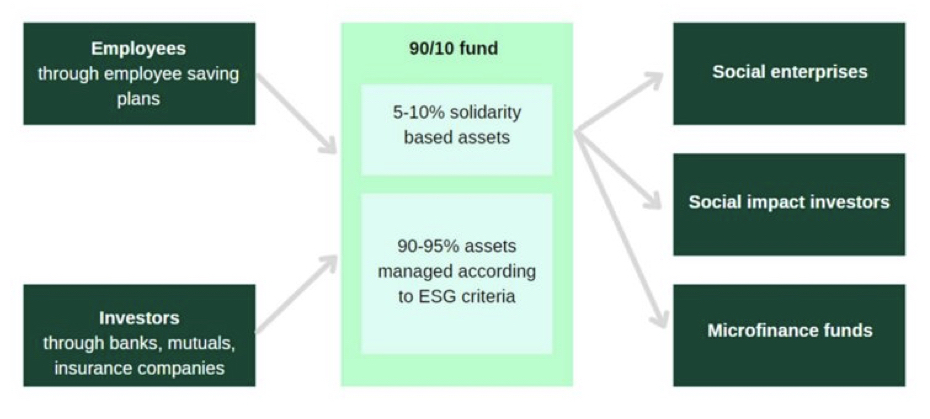

The 90/10 funds, commonly known as such due to their composition, were officially created in 2001 in France. They are required to invest 5-10% of their assets in social enterprises2, either directly or through a dedicated non-listed fund (Fonds Professionnel Spécialisé or FPS), while the remaining 90-95% are listed assets managed according to ESG criteria. 90/10 funds are equally profitable as non-90/10 funds, which underlines the success of this model for consumers. At the same time, the expansion of 90/10 funds aids the social economy greatly by stabilising financial flows into critical social infrastructure.

Very simplified, this is how a 90/10 fund works3:

Thanks to a favourable legal framework and a strong demand from investors, 22 years later, 90/10 funds are thriving in France. In fact, the stock of investment in solidarity funds was estimated €400-500 million in 2015, and is now estimated at €1.2 billion.

90/10 funds' legal history

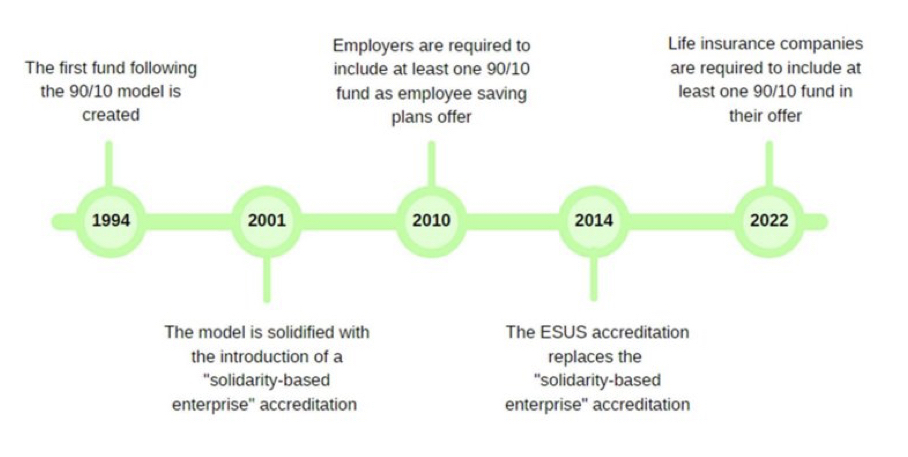

The first solidarity based fund was created in 1994 in France; it was managed by Mirova, and was awarded the Finansol label in 1997.4

The growth of the 90/10 funds has been stimulated greatly by three legislations:

- In 2001, the Fabius law on employee savings creation enshrined two mechanisms: one, it provided solidarity-based investment in PPESVs (voluntary employee partnership savings plan) and second it defined the ‘solidarity-based enterprise.’

- In 2008, the Law on the Modernisation of the Economy (LME) extended to all Company Savings Plans (PEE, employee savings schemes) the obligation to present at least one solidarity fund to employees benefiting from this type of scheme5

- From 2022, the Loi Pacte legislates that life insurance companies are required to offer at least one socially responsible unit trust in their multi-support policies. In principle, these will be 90/10 funds.

In between these laws for financial services companies, in 2014 the ESUS accreditation provided a rigorous definition of the social utility and an assessment of reinvestment of any profit into the activity, as well as other governance criteria. This legal environment, following courageous pioneering efforts, continues to provide transparency and increase consumer confidence. So, what role, finally, does data play in terms of policies?

Building blocks for better data and concerted action

The answer to this question lies in the data management and subsequent action. In 2021 iiLab and Finansol merged to build FAIR. Since then, although the label Finansol continues to be wholly independent with a separate governing council, the data for the label is managed by FAIR. Just, recently in 2023, FAIR developed its proprietary data management to produce its three flagship annual social economy overviews, the Barometre (with LaCroix), the Zoom and the Panorama for Social Impact Finance. During the production of these publications, the trends, successes and failures of the system become obvious, lead to internal discussions and, finally, actions. Overall, the entity called iiLab/Finansol/FAIR has been managing data and improving the process for 25 years.

In particular, the label Finansol asked actively for data on sustainability since its inception for the whole 90/10 fund. The methodology is being continuously renewed based on rigorous review of the governing council. Funds renewing their certificate are checked every year. Despite annual de-labellisations, there is continuous growth in the number of labelled funds; in 2022, 187 products have the label Finansol (178 products in 2021), despite 7 de-labellisations.6

Based on this data and the subsequent consultation with the ecosystem’s stakeholders on trends and shortcomings, FAIR’s policy department defines its actions in France and Europe. Currently, there are several European policies which the policy department’s action seeks to innovate on. One example is the General Block Exemption Regulation (GBER) under which social enterprises are equated to SMEs, despite having different financing needs. FAIR is working to propose adjustments to European regulation to better adapt it to the specificities of social economy actors. Furthermore, and specifically on the topic of 90/10 funds, these cannot be sold to retail investors outside of France, due to their use of promissory notes which are not recognised under the Undertakings for Collective Investment in Transferable Securities (UCITS) directive. Yet, there is interest to copy the model of the 90/10 funds in Spain, UK and other countries, or to at least expand its use. Hence, FAIR’s policy department is proposing several innovations on the UCITS directive.

In conclusion, data and policy interact in different ways. While data is both an input, output and overall guidepost for policy innovation, it is only effective if put into action and is in fact being shaped again by action. In the case of 90/10 funds, FAIR’s data gathering activities have provided the proof of concept for 90/10 funds which FAIR is working to expand to the European level in the hope of eradicating financing failures in the European social economy.

*

1 Zoom 2023-2024 (forthcoming September 2023) available here

2 The composition of the funds is defined in Article L214-164 of the Code monétaire et financier. Here, social enterprises are understood as defined in French law that have received an ESUS accreditation from 2014 (ici en francais)

3 See also EVPA, 2017, the 90/10 solidarity funds, available here

4 Finansol, 2019, STUDY ON ‘90/10’ FUNDS, available here, p.4

5 https://www.finance-fair.org/fr/actualites/les-fonds-9010-fierte-de-la-finance-solidaire-en-france

6 Zoom 2023-2024 (forthcoming September 2023) available here

Partners