Say you want to learn how to play a niche sport, like lacrosse. You might know a thing or two about the rules and the materials (the stick is called a ‘crosse’, by the way). But still, you might want to talk to an actual player to really learn what it is all about.

The same holds true for setting up and managing an impact fund. While it is definitely possible to learn how to do this autonomously, it will invariably prove helpful to involve someone who has first-hand experience in this field.

Enter Robert Manz. Robert has more than 30 years' experience in the private equity industry in Central & Eastern Europe. He is the co-creator of the Valores Foundation, Poland’s first venture philanthropy fund and a long-time EVPA member.

Robert Manz ...

- is a co-creator and board member of the Valores Foundation, Poland's first venture philanthropy fund

- is a founding President of the Polish Private Equity and Venture Capital Association ("PSIK"), and currently heads the PSIK Philanthropy Committee that created and oversees the PSIK Social Business Accelerator (SBA) Program

- was a managing Partner of Enterprise Investors, the leading private equity fund manager in CEE

- served as Chairman of the Central and Eastern Europe Task Force of Invest Europe, from 2003 until 2020

Most importantly, Robert has real, tangible experience in managing impact investments. This, we thought, makes him an excellent conversation partner for our Collaborate For Impact and Impact Together partners.

Some of our partners have already set up an impact fund in their region (Actio Fund in Georgia, VIA Fund in Armenia and USVF in Ukraine). Others are still building towards this future. All of them can learn a thing or two from Robert, though.

So we brought them together. Curious to see what we learned?

> TAKEAWAY 1: The work of an impact fund goes far beyond the financial.

Robert Manz identifies three core pillars of venture philanthropy fund work: tailored financial support, impact measurement and management, and crucially, non-financial support. ‘We actually believe this is the most important pillar of our work’, says Manz.

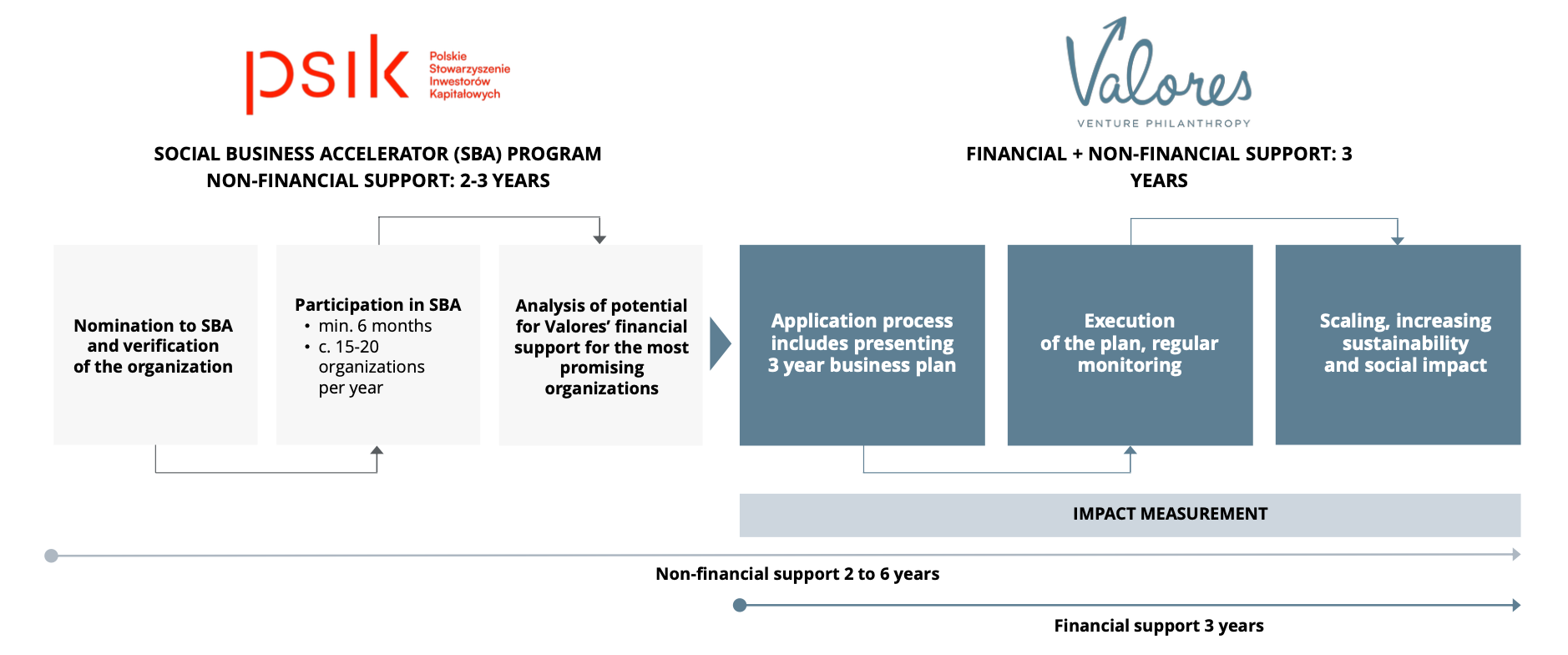

This support mainly comes in the form of mentorships and pro bono support by experts. Organisations that seek financial support from Valores Foundation are first enrolled in the PSIK Social Business Accelerator Program (SBA) for mentorship purposes and to be trained and screened for investment readiness.

The advantages are two-fold: on the one hand, possible donors in the fund can get involved in a non-financial way and get acquainted with the program from the inside, before (hopefully) expanding their contribution to include actual investments. The participants, on the other hand, get targeted support to help take the next step.

> TAKEAWAY 2: Patience is key, persistance is golden.

It takes times to construct something lasting. Manz states that from all organizations that enter the PSIK SBA program, perhaps one in five will progress to become a part of the Valores Foundation portfolio.

If the business is simply not ready to take the next step, it makes little sense to invest, but a lot of sense to continue with mentorship and other non-financial support instead. In general, any given organisation will receive non-financial support for up to 6 years, and if eligible, financial support for up to 3 years from Valores:

Evidence of this approach was shown in a few successful case studies from the Valores portfolio, such as the Fundacja Ocalenie (a migrant and refugee immigration project) and Twoje Nowe Możliwości (a project for students with disabilities), who both exited the portfolio after 3 tot 4 years with impressive results.

> TAKEAWAY 3: People can be changemakers as much as organisations can.

The Valores Foundation is funded exclusively by private, individual donors. Not only this, but the foundation is largely made possible by pro bono work. It goes to show how much change can be enacted by reaching out to individuals, whether they be possible investors/donors, mentors, legal experts or other human pieces of the puzzle. Finding so-called ‘champions’ for your cause will prove invaluable to the effectiveness of any impact fund.

Of course, the learning doesn’t end here. There are more learning sessions planned for our partners in the Collaborate For Impact and Impact Together programmes. We keep building, in our case an impact investing ecosystem. And the best building happens one block at a time.

Who knows - we might even end up picking up some lacrosse skills along the way.